“Give me six hours to cut down a tree, and I’ll spend the first four hours sharpening my axe.” Abraham Lincoln

For many businesses, tax season can be an incredibly stressful time. On top of the near-endless list of projects and deliverables involved in your day-to-day operations, gathering documents, meeting deadlines, and staying compliant with changes in tax laws can feel overwhelming for even the most organized among us.

And while good old “Honest Abe” himself created the Internal Revenue Service (IRS) back in 1862, he left us plenty of clues, like the axe-sharpening axiom above, on how best to approach our tax tasks.

Having a plan and putting in work ahead of time can help diffuse the stress, and we’ve gathered up some of the best current-day advice and insights to help make tax time tolerable. Let’s get started.

1. Organize Financial Records Early.

The foundation of any smooth tax season is having well-organized financial records. Businesses that prioritize organizing, collecting, and reviewing financial documents long before tax deadlines position themselves for success. This includes:

- Income Statements: Ensure all revenue is accurately recorded.

- Expense Reports: Categorize and verify all business expenses.

- Receipts: Gather and store receipts for deductible purchases.

- Invoices and Bank Statements: Reconcile accounts to ensure all income and expenditures are accounted for.

Having these documents in order will make it easier for your accountant or tax preparer to calculate your taxes accurately, and it will help you avoid the stress of scrambling at the last minute.

Varsity Tip: The non-profit organization Service Corps of Retired Executives, known most widely as SCORE, suggests an even bolder strategy. “Taking just thirty minutes at the end of the week to reconcile your books, electronically file your receipts, plan for quarterly payments, and more will get you organized and ready for next year’s tax time.” Whether you allot time each week, each quarter, or even just a few weeks ahead of the deadline, putting in the time early will yield long-term positive results.

2. Review Potential Tax Deductions

One of the best ways to reduce your business’s tax liability is to take advantage of all available tax deductions. Deductions lower your taxable income, resulting in a smaller tax bill. For businesses, some common deductions include:

- Office Supplies: Pens, paper, and other office-related expenses.

- Business Travel and Meals: Costs incurred during work-related trips.

- Employee Salaries and Benefits: Including health insurance and retirement plan contributions.

- Home Office Deduction: For those who qualify for working from a home office.

- Vehicle Use: Mileage and expenses incurred during business travel.

Review your business expenses with your accountant to ensure you’re maximizing your deductions.

Varsity Tip: Deductions usually require documentation. Long gone are the days of storing receipts in shoe boxes; modern tech tools have increased the efficiency of storing and sorting information. Various applications can help you photograph and categorize your documents to make them more usable at tax time.

3. Evaluate Tax Credits

Tax credits directly reduce the amount of taxes you owe and can be incredibly valuable. Some businesses may qualify for credits such as:

- For companies that invest in innovation, the Research and Development (R&D) Tax Credit is available.

- Small Business Health Care Tax Credit: This tax credit is for small businesses that provide health insurance to employees.

- Work Opportunity Tax Credit: For hiring employees from certain targeted groups.

- Clean Vehicle Credit: That Electric Vehicle (EV) or Fuel Cell Vehicle (FCV) you acquired for your business may also provide tax advantages.

Tax credits can result in significant savings, so it’s important to research and determine which ones apply to your business.

Varsity Tip: Curious about which tax credits you may be eligible for? The IRS has a section of their website dedicated to helping tax payers identify and claim credits.

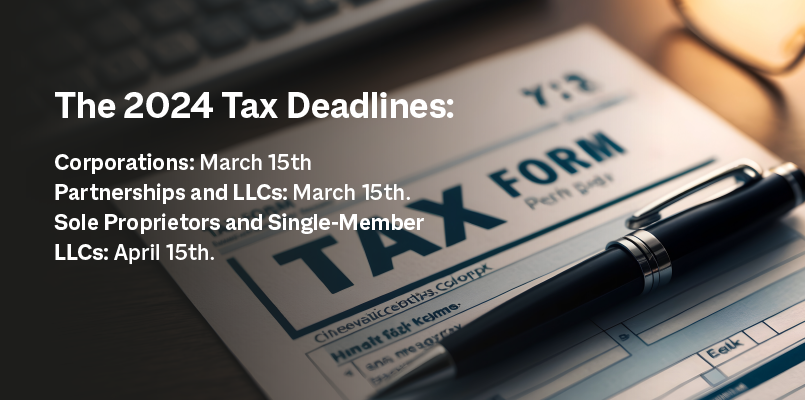

4. Understand Applicable Tax Deadlines

It’s crucial for businesses to be aware of all applicable tax deadlines, as missing them can result in penalties and interest charges. For most businesses, tax deadlines vary based on their entity structure:

- Corporations: March 15th (or the 15th day of the third month of the fiscal year).

- Partnerships and LLCs: March 15th.

- Sole Proprietors and Single-Member LLCs: April 15th.

- Note: Should dates fall on a Saturday, Sunday, or legal holiday, taxes and tax documents are due on the next business day that is not a Saturday, Sunday, or holiday.

- In addition to filing deadlines, businesses may also need to makequarterly estimated tax payments. Staying aware of these deadlines allows businesses to avoid penalties and manage their cash flow effectively.

Here’s a quick look at key dates in calendar year 2025. Note, at press time dates were still being finalized. Please check with your tax professional for deadlines.

| Date | What’s Due (for Federal taxes) |

| January 15, 2025 | Corporations The fourth estimated FY2024 tax payment is due. |

| January 31, 2025 | All Businesses W-2 or W-3 forms are due to 2025 employees. 1099, 1099-MISC, 1099-DIV, 1099-INT, 1099-R, or 1099-NEC forms are due to recipients of certain payments made during 2024. |

| March 17, 2025 | Partnerships | Limited Liability Companies | S Corporations 2024 calendar year-end business tax returns are due. Your state or pass-through entity tax payment may also be due. |

| April 15, 2025 | C-Corporations 2024 federal taxes are due with payment if owed for corporations. If your C-Corporation needs to file a federal tax extension, the extension is due with an estimated tax payment. Corporations The first estimated FY2025 tax payment is due. |

| June 15, 2025 | Corporations The second estimated FY2025 tax payment is due. |

| September 15, 2025 | Partnership | S corporation If you filed a 2024 tax extension, then your FY2024 tax return and payment, if owed, are due. Corporations The third estimated FY2025 tax payment is due. |

| October 15, 2025 | C-Corporations If you filed an extension on your FY2024 taxes, they are due with payment, any tax, interest, and penalties. |

5. Ensure Timely and Accurate Document Delivery

When it comes to tax filing, timely and accurate delivery of documents is crucial. Whether you’re sending W-2s, 1099s, or other essential tax forms, you need to ensure that these documents reach their intended recipients on time. Missing deadlines or having tax documents lost in the mail can result in penalties, delays, and frustrated clients. Reliable mail delivery tracking can help reduce stress and increase results. PrintMail understands the critical role that enhanced mail tracking plays in simplifying tax processes and ensuring a smoother tax season.

Enhanced Mail Tracking gives you the ability to monitor the status of your mail in real time. You can track when documents are printed, mailed, and delivered to their destination. This not only gives you peace of mind but also helps you provide proof of mailing and delivery should any issues arise.

Improved Compliance and Record-Keeping

Compliance with tax regulations requires careful documentation and record-keeping. Using enhanced mail tracking, you can create a digital log of all sent tax forms and their delivery status. When you need to verify the timely delivery of forms or respond to audits, this log becomes an invaluable resource.

Enhanced mail tracking allows you to:

- Monitor each document’s mailing status.

- Access timestamps showing when items were sent and received.

- Keep digital records for quick retrieval in the future.

This simplifies the process of maintaining accurate records and staying compliant with tax deadlines.

Increased Accountability and Transparency

When tax documents are lost or delayed, it can create confusion and frustration for both you and your clients. With enhanced mail tracking, you can provide clients with transparency about the status of their important tax forms. They’ll know exactly when to expect their documents, and you’ll have proof that they were sent on time.

Reduced Administrative Burden

Enhanced mail tracking systems automatically log delivery information and provide updates on the status of each piece of mail. This automation reduces the administrative burden on your team, freeing them up to focus on more critical aspects of tax preparation.

With a streamlined mail tracking process, you can:

- Avoid manual data entry and reduce errors.

- Eliminate the need for follow-up calls and emails to check delivery statuses.

- Quickly identify and resolve any mailing issues.

6. Partner with PrintMail for Your Tax Form Processing Needs

To alleviate time crunches and prevent costly errors, more companies are turning to tax document outsourcing services to meet their needs. Not only can they take these extraneous burdens off of staff, they can also help ensure that tax documents are accurate, delivered on schedule, and adhere to local, state, and federal regulations.

Varsity Tip: At PrintMail, we offer cost-effective, fast, and reliable print and mail tax form processing services for government agencies, townships and municipalities, financial institutions and services, nonprofit organizations, and others. Reach out to us today to learn more about how we can help.

With the right practices and partnerships, managing your tax documents can become a smoother, if not easier, process. Plan now to make tax season a success, and be sure to follow along on our blog for additional articles and insights to help you tackle business challenges.

Join Our Mailing List

Receive new blog posts via email!